cTrader

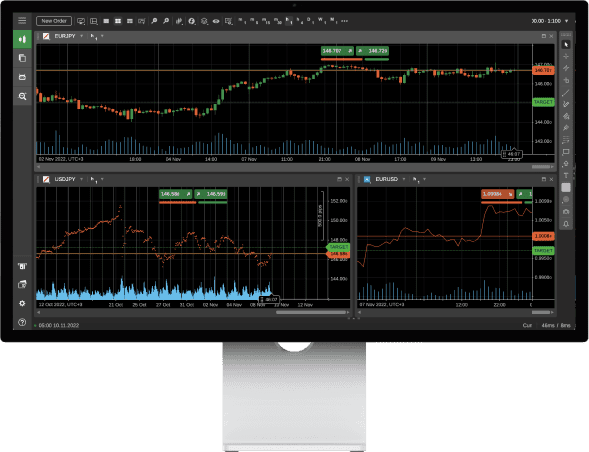

Use cTrader directly through your browser - no downloads, no setups. Access one of the world’s most advanced trading platforms with desktop-version-identical functionality that includes more market depth options, 26 timeframes and 70+ inbuilt indicators.

Try cTrader Web

Why Trade on cTrader Web?

Use your account on Chrome, Firefox, Safari, Microsoft Edge and more. Get the same functionality as your desktop application right in your browser.

Compatible with any HTML-5 browser you can access cTraders webtrader on any device: laptop, tablet, phone. Need to access your account, but don’t have time to download? Just login to cTrader account through your browser.

cTrader Web allows you to see 3 different depth of market charts that gives you a deeper overview of the market: Standard depth, Price Depth, and VWAP depth.

Create, adjust, or delete orders/positions with just one click. Experience trading with cTraders intuitive interface and range of quick trade tools.

Control your risk with cTraders suite of risk management tools. Such as hovering over the “quantity” to see your pip value, trade values, commission, and margin to get a full overview of your position and how it will alter at different lot sizes.

See various chart types from renko charts to tick charts. Adjust your charts with cTrader’s 26 timeframes and 70+ inbuilt indicators. Create your perfect trade setup.

FAQs

No! cTrader’s webtrader has identical functionality to its desktop counterpart, so you still get the full cTrader experience when trading through a browser.

Yes, create a demo account easily via your Fusion Markets’ Client Hub (ensure to use the demo server when you log in).

Fusion Markets’ clients have access to Fusion Markets’ Zero. Swap-free accounts are also in the pipeline for the near future. See our FAQs on why we don’t offer the classic account.

We pride ourselves on our low costs and we continue this with cTrader. Although commissions will feel very similar between MetaTrader and cTrader, there is an important difference in calculation that you need to understand to ensure you accurately account for your costs.

In MetaTrader, commissions are charged per lot. In cTrader, commissions are charged at a rate of $2.25 per $100,000 of notional volume traded (both in the base currency traded).

So, in cTrader if you trade 1 lot of EURUSD (EUR 100,000 notional value traded per side), the commission will be EUR 2.25 per side or EUR 4.5 round-turn. However, if you trade 1 lot of AUDUSD (AUD $100,000 notional value), the commission will be AUD $2.25 (per side) or AUD $4.5 round-turn.

From the above two examples, you can see that the commissions are slightly different per-lot, because the commission charge will always be proportional to the notional volume traded rather than the lots traded. The EUR trade charges commission in Euros and the AUD trade charges commission in Australian Dollars, making the costs of the trades slightly different - these amounts would then be converted back to your account currency automatically.

Another important difference to consider is when a standard lot is not exactly 100,000 notional value for all products, such as when trading Gold or Silver.

With these instruments, you need to consider the notional value and not just the lot size. As in the above examples, when you trade US $100,000 notional value, your commission will still be US$2.25.

Log into your Client Hub, click “payments” and choose your funding method. Once funds arrive in your account, you’ll be able to trade on cTrader.